The IRS has admitted that the average tax refund has shrunk by nearly 17 percent this year. This is for the early filers, of course, and the early filers tend to be people who usually get big refunds. Now there are lots of news stories about lots of people who were shocked at their tax bills; see, for example, Denver Woman Surprised With $8,000 Tax Bill After Expecting Refund.

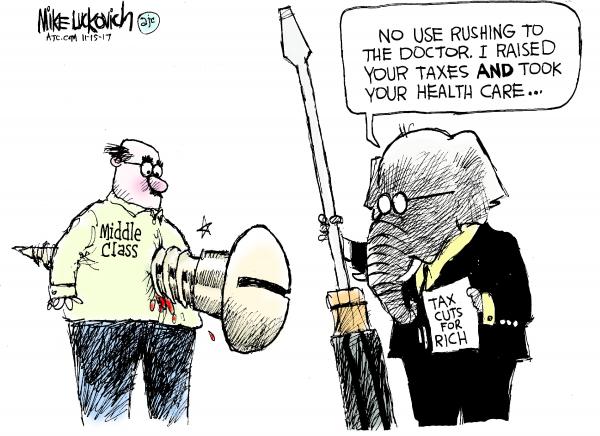

This has left Republicans scrambling to explain why their glorious tax cuts are leaving people with bigger tax bills.

With headlines blaring about smaller refunds in the first weeks of the three-month filing season, GOP lawmakers and their supporters are working in tandem to remind people that the GOP tax overhaul cut almost everyone’s taxes last year, regardless of what their tax refunds look like this year.

Typically, Republicans are falling back on blaming the victim — people who owe money didn’t withhold enough. Democrats have accused theTrump IRS of deliberately miscalculating withholding to give people more take-home pay and the illusion of a larger tax cut. This was supposed to help Republicans win the midterms, remember. But never fear — Banks made record profits last year thanks to the Republican tax cuts.

At least, maybe it’ll be harder for Republicans to sell tax cuts as the cure for all ills going forward. We’ll see.

Elsewhere — Paul Manafort could get as much as 22 years in prison, according to a court filing unsealed today. He’ll be sentenced next month.