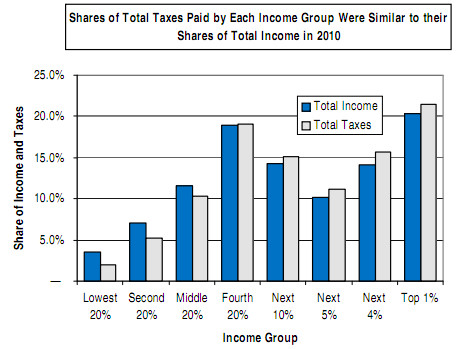

Following up the recent commenter who repeated the oft-told lie that wealthy people carry most of the tax burden — Paul Krugman addresses this on his blog today, in a post called “Zombie Tax Lies.” If you figure all taxes — income, FICA, state taxes, etc. — the percentage of the total tax burden is remarkably un-progressive —

Again, the blue bar shows percentage of income, and the gray bar shows what percentage of the total tax burden is paid by that income group. For more data, see Citizens for Tax Justice.

And isn’t it remarkable that when the zombies want to talk about the budget deficit and what’s causing it, they talk about Social Security and Medicare and how they have to be cut, even though the Social Security program isn’t on the budget.

But when they want to talk about who pays the most taxes, for some reason FICA taxes don’t count. But FICA taxes are not progressive at all. Everybody pays the same rate for income up to $106,800, and income above that isn’t taxed at all. Since FICA taxes don’t count as taxes in the minds of the wealthy, you’d think they wouldn’t argue about having that cap lifted, would you?

And talk about taxes being a burden to small business– if you are employed, the employer pays a portion of the total FICA tax. As a self-employed person, I pay the entire FICA tax, called the “self-employment tax.” It’s a real bite.

Anyway — for your viewing pleasure — here’s another zombie congressman, Sean Duffy of Wisconsin, being skewered by actual thinking persons who know what they’re talking about —

I’m confused by conflicting information. When I go to FactCheck.org: http://www.factcheck.org/2011/02/democrats-deny-social-securitys-red-ink/

They say Social Security does add to the deficit, yet I recently heard that Social Security numbers are based on an annual GNP of 2.1 percent. If this is true, our GNP has been over 2.1 even in bad years for the most part. Now I haven’t been able to locate a site that supports what I heard on the radio, but again, I’m not sure who or what to believe.

I don’t think I was clear in my GNP explanation. The point that was being addressed was the meme that Social Security can only pay 100 percent of the benefits for 20 some more years, which afterwards can only payout 70 percent for another 20 some years. The premise of how SS is structured based on a 2.1 growth rate means that SS should be able to continue for many more years past what the critics claim now. And if this is so, then it would appear to conflict with Fact Ceck’s info. I hope this clears up my initial post, although my initial confusion remains.

There must be some Island of Dr. Moraeu, where Conservatives implant the handsome and good hair genes into an egg, and then have the young child’s brain removed and have the empty cranium implanted with a digital voice recorder, to come up with politicians like Ryan, Murphy and Duffy (weren’t the old Irish usually Democrats? They were in NYC when I was a kid).

And then they have contests, with the ones who appeal to real people the most then slated to run for office. – where the power and money is. Those who just lose by a little become TV ministers (where the REAL money is). The children for whom the handsome and hairy genes didn’t take, but the recorder did, become columnists, like “Wrong Again” Kristol, and Chuckles DoucheNozzle, with the really ugly, even less intelligent and talented, slated to be internet trolls like the ones we get here.

Again, watching the Duffy video, I’m struck by how civil “our” side is compared to the hysterical histrionic hordes who got plenty of air time on the TV news shows the last two years.

Maybe we need stupid outfits too!

Let’s see, they used the Revolutionary period, so that’s out.

Hmmm… Civil War! Nope, that was the last time the Republicans were on the right side of an issue (ok, Civil Rights, too).

I know – TOGA’S!

We could say we represent the spirit of the Greeks and Romans who were the basis for our form of representative democracy.

And just think of the parties!

“Toga! Toga!! TOGA!!!”

Senator Blutarski would love it, but he’s probably turned out to be a Republican. He probably went on to get an MBA with that other well known drunken partying frat boy – George W. Bush.

I myself was the proud member of two fraternities:

I Delta Ounce.

And Tappa Kegga Beer.*

We also had Grabba Bitta Tushy on campus, but believe it or not, that was a sorority! They wanted to give it back at ’em as good as they got.**

*Just kidding. I didn’t join any of the fraternities available at my college. They were just organized drunks, and, since I’m a Liberal, I usually disdain things that are organized.

I was a free range drunk.

**Just making crap up, like usual.

Chris — It depends on which deficit you’re talking about. Social Security is not part of the federal budget at all. The Social Security Administration is on a separate budget, and the taxes you pay to support Social Security are not counted as general revenue.

So if you’re talking about a deficit in the federal budget, it is correct to say that Social Security is not the problem, because Social Security is not part of the budget.

However, Social Security is part of overall federal spending. So if you’re looking at overall spending and not just items in the budget of general revenues and expenditures, then it counts.

Notice that Annenberg is using the phrase “overall federal deficit” and not “federal budget deficit.” The Democrats they are quoting appeared to be talking about the federal budget deficit, however. So Annenberg’s claim is dishonest; the Dems are talking about apples, and Annenberg is talking about oranges.

I think Annenberg is wrong here —

“Social Security has passed a tipping point. For years it generated more revenue than it consumed, holding down the overall federal deficit and allowing Congress to spend more freely for other things. But those days are gone. Rather than lessening the federal deficit, Social Security has at last — as long predicted — become a drag on the government’s overall finances.”

Last year, I believe for the first time, Social Security paid out more than it took in. This was mostly because of widespread unemployment — revenue was down. The sluggish recovery, coupled by the fact that the first of the Baby Boomers reached 65, has caused some analysts to project this deficit to be permanent and that it will cause the entire trust fund to be drained by 2037.

However, my understanding is that isn’t necessarily written in stone, and if the economy were to pick up even slightly more than the projectors figured, Social Security will be fine into the infinite future (this is perhaps what you are talking about with the GNP). So while it’s a concern, it’s small potatoes compared to other stuff.

I also wonder what’s gotten into Annenberg. This is the second “fact check” I’ve seen this week that fell back on right-wing talking points and obfustication.

One place where there’s confusion is that the Social Security trust fund was a guaranteed buyer of government bonds for a good many years, and this reduced “the budget deficit” – the difference between revenue and expenditure. Clinton’s budgets put us in a situation in which the trust fund was buying a bit more in bonds than we needed to sell, and thus, left us with a small “surplus” – but it wasn’t a real surplus. General fund income did not match general fund expenditures.

George W. campaigned on giving “part” (economists knew full well his proposals would give it all) of that “surplus” back in the form of tax cuts. What that meant, at the time, was he said “right now, your social security excess is retiring some of our old bonds, and replacing them with bonds owed to future retirees. Instead of doing that, I want to give it away to the wealthy – and I’ll throw some scraps at the middle and working class, too.”

If social security spends more than it takes in (and has to cash in some of its bonds) it does affect the deficit, because we have to sell new bonds to make up the shortfall.

But it doesn’t affect “the deficit” in any direct manner.

Here’s an analogy. Let’s suppose an HVAC contractor sells you a maintenance plan, promising to actually replace your furnace if necessary. You’ve paid for that plan for a few years, knowing full well that you were paying more each year than you were receiving in furnace cleanings and preventative maintenance. Then, your furnace up and dies, and it can’t be fixed. The HVAC contractor has fallen on hard times because the economy sucks. Does your maintenance plan affect their budget problems? In one sense, yes, it does – they have to spend money they’d rather not spend right now. But, assuming that the maintenance plan was priced correctly, the proper answer is “no” – it doesn’t affect their budget. They received a good price for replacing your furnace when necessary, they had this outstanding liability that they knew they had to take care of, sooner or later, and they knew there was a random element to it. It’s bad luck that the liability came due when it did – but that’s part of running a business.

Re: “But when they want to talk about who pays the most taxes, for some reason FICA taxes don’t count. But FICA taxes are not progressive at all. Everybody pays the same rate for income up to $106,800, and income above that isn’t taxed at all. Since FICA taxes don’t count as taxes in the minds of the wealthy, you’d think they wouldn’t argue about having that cap lifted, would you?

Social Security is, arguably, forced savings – the benefits received in the future are strongly linked to the taxes paid in today, subject to upper limits on benefits that give it a progressive tilt. Since the match between taxes paid and (the increase in expected value of) benefits received is pretty close, one might argue that it is not appropriate to count FICA in the overall tax burden. By way of contrast, try matching your taxes with your benefits relative to the defense budget, or ag subsidies. Good luck.

If the cap on payroll taxes were lifted *and* the cap on benefits were lifted, I bet some opponents of raising the ceiling would in fact pipe down. But no one is proposing an increase in future benefits.

Tortured. It’s not a “savings” because the money we put in isn’t really the money we take out. Working people’s taxes pay the benefits of those already retired. And the money you take out is not limited to what you put in, plus interest. It’s there as long as you are alive. Conversely, if you are hit by a bus the day after you enroll in Social Security, your heirs can’t collect a jackpot of “savings.”

So, it’s a benefit program, and taxes pay for it the same way they pay for all the other benefit programs.

I didn’t watch the Sean Duffy video (I’m not up for sullying my beautiful mind with wingnuttia), but I immediately recognized the graph on his flip chart as one intending to portray the country’s deficits projected. It’s the same identical graph I saw on the front page of Investors Business Daily, the day after private Ryan announced his proposal. I forget the exactly language they used, but the IBD thought Ryan’s proposal was eminently sensible and exactly what the country needs. There must be some sort of Wingnut Central where these people get their slides and talking points, as it’s all coordinated.

I believe I found the original chart at IBD. The chart appears to be a creation of IBD. It sites “OMB/CBO (April 2011) as a source, but without knowing exactly what OMB an CBO say about the data, there’s no way to know what the chart represents, exactly. It looks very ominous, of course, which is the point.

There are two other tax situations Republicans never count.

People who rent pay property taxes, not the landlord. The landlord simply gathers the money and writes the check. Why is it the renter and not the landlord who pays the tax? Simple. If property taxes go up, the landlord raises the rent. If property taxes go down, the landlord keeps the money and never lowers the rent. The renter always pays.

Second situation. In many poor areas, people do not have access to good transportation to grocery stores. So they buy high-priced goods from liquor stores and corner marts. In many states, this means higher sales tax as well.

Actually, there are many other situations where flat fees charged by the government are a burden on the poor but barely noticed by the rich.

For thirty years, the reality in the United States is that taxes have become increasingly regressive.

I’m not a religious man, but Happy Easter everybody (Happy Passover, too)!

In the Russian Orthodox Church we say, as we kiss each others cheeks three times (for the Trinity), “Hreestoss Vosskress.” which means ‘Christ has risen.”

The response is “Voyeesteena Vosskress,” which means, ‘Truly he has risen.’

I just made baked ham, with pineapple and orange marmalade glaze, with potato’s cooked in the ham fat. YUM!

EMS!!! Someone call 911!!!

gulag, in the Russian Orthodox/Old Believers church of my youth – and I’m very familiar with the greeting and response you listed – there was a large “XB” illuminated on the belltower, which would be lit at midnight as the bells were rung. “XB” is of course cyrillic for Hreestoss Vosskress. Enjoy the traditional feast.

Maha, rather than calling Social Security a “benefits program”, why not call it by its official name: “Old-Age, Survivors, and Disability Insurance (OASDI) program” (Wikipedia). It is an insurance program. As such, it’s a lot like any other insurance program: auto insurance, homeowners insurance, etc. That’s why I don’t understand people who think that Social Security premiums are “their” money. As you point out, a person’s benefits may be much more than what was paid in by that person. And try asking for your money back from an auto insurance company when you stop driving!

It is purposefully misleading (or beside the point), but I don’t think it is a lie to say that rich people are paying an increasingly greater proportion of taxes. Statistically speaking, that’s just what happens when the rich get richer and the poor get poorer or unemployed.

Thanks moonbat!

Pingback: Red Cap Lighthouse wallpaper – Republicans Have Guiding Principles Issues « The Long Goodbye

That chart simply illustrates that taxes are too high all around, and of course the implication is that we need to cut spending across the board.

What is it with you statist socialist freaks? Leave people alone, at all income levels. Let them keep their money — and their liberty.

Freaking progressive douchebag losers. Damn you are fail.

Something tells me The Donalde doesn’t grasp what the bars represent, since there is no sensible way one could draw that conclusion from the chart.

It’s American NeoCLOWN!

Hey Clownie,

How’s it hangin’?

I mean besides tiny, limp and diseased!

“Freaking progressive douchebag losers. Damn you are fail.”

Damn you are fail?

Is English a 2nd language for you?

Here, let me reword it correctly:

‘Freaking Conservative douchebag losers. Damn you are stupid!

Bye, Clowne!

Don’t forget to write.

When you learn how.

Oh, and a Happy Easter to you Clownie!

Better stick with the pure white chocolate bunnies.

You don’t want any of those milk ones that are the product of white-black chocolate bunny miscegenation.

And stay away from the dark chocolate Mau Mau bunnies. They’re up to no good!

‘

Actually, I think that was a fake AmericanNEOCLOWN.

I saw “The Donalde” on LG&M, and he’s a takeoff on Donald Douglas.